Qualidade Baseus, sempre excelente e confiável.

Nessa faixa de preço se torna um dos melhores custo-benefício, principalmente por causa da sua construção, como leva o nome da Baseus os materiais e acabamentos são de maior qualidade, sem contar a vantagem do tamanho mini e da conexão com o aplicativo.

super powerful jet. it works just as described

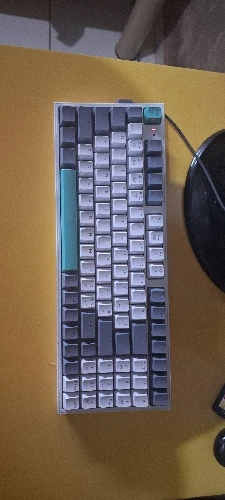

teclado muito bom, gostoso e confortável de mexer, recomendo muito, ótimo custo benéfico ainda mais se for o primeiro teclado mecânico, lembrando que ele está no padrão americano, não possui o ç mas se seu PC estiver no padrão abnt2 de fábrica, ele vai ter o ç normalmente.

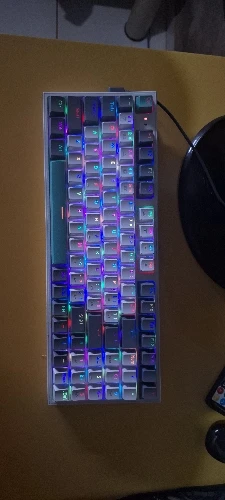

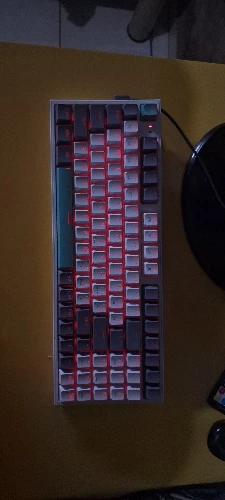

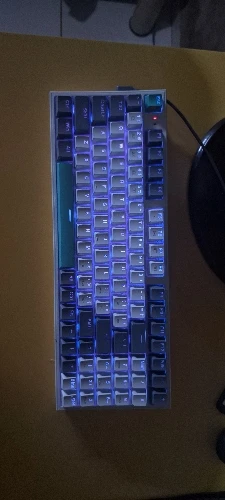

possui iluminação rgb, personalizáveis, cores bonitas e bem brilhosas.

teclado muito bom, gostoso e confortável de mexer, recomendo muito, ótimo custo benéfico ainda mais se for o primeiro teclado mecânico, lembrando que ele está no padrão americano, não possui o ç mas se seu PC estiver no padrão abnt2 de fábrica, ele vai ter o ç normalmente.

possui iluminação rgb, personalizáveis, cores bonitas e bem brilhosas.